WAKE UP!

Hey Jack! Reality confirms what we discussed in our last meeting, when Nicco explained that the advantage in a trade war is with the seller, not the importer. In our current case, the advantage is with China, not the United States.

Laurie, sitting with Raven on the other side of the table, said,

“I could not attend that meeting. Could you tell me what you discussed?”

Nicco took the question.

“In that discussion, we noted that the economic objective in a war is to deny the enemy access to the international supply chains because if you attain this objective, you force it to fight the war only with the resources it has in its territory. That is, if the enemy can produce only 100 tanks with its domestic resources do not allow it to import 200 from the rest of the world. If you allow it to import the tanks, you will face 300, not 100, tanks on the battlefield. Elementary, my dear Jack!

“Now, how can you force your enemy to isolate from the rest of the world? I can think of three ways. Two are the classical economic methods and the third is an innovation of our times. The first is to blockade your enemy, militarily or otherwise. The Germans, for example, sent submarines to sink the ships that carried imports to the UK, knowing that if they sank a large enough number of them England would be unable to continue fighting. The other classical way would be to deny your enemy access to financing the imports. In any of these two cases, you reduce your enemy’s fighting capacity.

“And what is the third, innovative way?”

“I don’t know how to classify the third one. It’s political and can result from a stroke of luck or of cloak-and-dagger conspiracies…I know only one case in history, that of the United States today…it happens when your enemy's leader decides on his own volition to isolate his country from the rest of the world, inventing a foolish pretext to do it. It is not easy to do because it works only if it effectively isolates the country from all or most other countries. The Prince has been the best that could have happened to China in many centuries because he,

a) Declared a trade war against the rest of the world, alienating allies, friends, rivals, and enemies.

b) The weapon he uses is in itself an instrument of isolation. He doesn’t need to tell these other countries, ‘don’t export to me,’ because the tariffs themselves tend to reduce the amounts they can export to the United States because their products become more expensive, and if the tariffs are too high, they prevent trading altogether.

c) He then singled out China to impose the higher tariffs (at the last notice, I think, of 145%) to that country without paying attention to the fact that it needed China in two ways that cannot be easily compensated if China stopped exporting to the United States. These two ways are the following:

a. China exports certain crucial materials that the United States cannot easily obtain elsewhere, so if China decides not to export them, it can cause major damage to the United States.

b. Since China is one of the major purchasers of US Treasury bonds, if it decides to stop buying them, it can increase the interest rate the Federal Government has to pay on its new debts. This can lead to a financial crisis in the United States. It is because The Prince’s adjutants have perceived this risk that he is trying to force the resignation of the Governor of the Federal Reserve, wrongly believing that he would be able to reduce the interest rate if he controlled that institution.

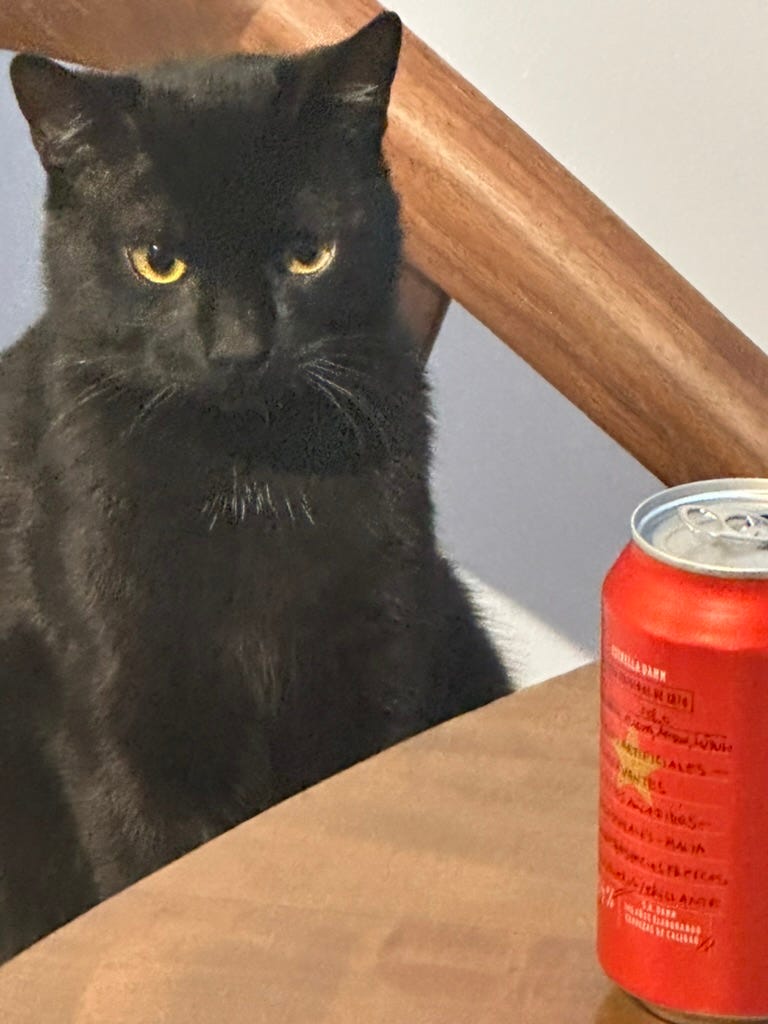

“As Raven, Laurie’s cat, could have foreseen if he spoke English and understood what we discussed…Laurie, that cat gets on my nerves. I think he understands what I am saying. Look at how he looks at me after I said this…”

“He does, Nicco, he understands…much more than The Prince and his Cabinet. But don’t worry, he has high self-esteem, he is not vengeful,” said Laurie.

“I hope so,” said Nicco, and then continued, “Well, I was saying that as anybody could have predicted, China blocked the exportation of rare earth metals a few days ago. And then, today, the Financial Times brings a piece of news about one of the first events in the war, a fully predictable one. Automotive companies have warned they have limited stocks of those rare earths and may be forced to shut down production within months if Beijing fully chokes off exports. There you go!”

RAVEN LOOKING AT NICCO

“According to the Financial Times,

Jan Giese, a metals trader at Frankfurt-based Tradium, warned that customers had been caught off guard and most car groups and their suppliers appear to be holding only two to three months’ worth of magnets.

“If we don’t see magnet deliveries to the EU or Japan in that time or at least close to that, then I think we will see genuine problems in the automotive supply chain,” said Giese.

China’s latest controls focused on “heavy” and “medium” rare earths that enable high-performance magnets that can withstand higher temperatures, such as dysprosium, terbium and samarium. These are vital for military applications such as jets, missiles and drones, as well as rotors, motors and transmissions that feature heavily in electric and hybrid vehicles. [1]

“This is amazing!” said John Maynard, suddenly furious, “How is it possible? I am not surprised that The Prince’s team could not foresee this because they, are, I don’t want to be unkind, limited, but…the private companies! We all knew that the trade war could come, from months and years ago because this is what The Prince did in his first period…and we were sure since he won the presidential election…he said it thousands of times…and the private sector did not prepare for it! What is happening to the private sector, risk analysis, and strategic planning?”

Laurie then intervened.

“And you know that the F-35, the kingpin of the air forces of the United States and NATO cannot be produced without rare earths…when I say kingpin I am not referring to it as the best airplane in our armory but to the center of air and land operations in the battlefield. Connected to sea, land, and air forces, it can act as the command center of combined operations. And it needs rare earths that only China produces…and The Prince launches a trade war on China without even increase the strategic stocks of those materials…And the private companies that produce the plane and its communication equipment do nothing to prepare themselves for what they knew, or should have known, or at least suspected, would happen? In what hands are we?”

“Well, you are right, John Maynard,” said Arnold, “But tell us about the problems that China faces due to the tariffs?”

“China will face two main challenges. One is similar to that faced by the United States: The Prince has forbidden Nvidia to export its H20 chips used to produce Artificial Intelligence engines. This sounds reasonable. Yet it is not. It will backfire. The H20 was designed to comply with export controls aimed at denying China access to the cutting-edge chips produced by Nvidia. It is not cutting-edge, and everybody knows that if forced, China will have the technological ability to make a similar chip by reverse engineering the H20. Stopping the supply of the top Nvidia chip resulted in the Chinese inventing the DeepSeek AI machine, which is slightly inferior but substantially cheaper than those built with the top Nvidia chips. In return, the prohibition will cause enormous losses to Nvidia ($5.5 billion right now and as much as $10 billion in the longer term), which will impair the company’s ability to invest in research and development to maintain its global leadership. Thus, The Prince has crippled one of the strategically crucial American enterprises in exchange for a dubious and temporary minor advantage.”[2]

“But, is not the same with the rare earths?”

“Not at all,” said Nicco, “the rare earths cannot be invented or reverse engineered in the United States…they are materials…nobody else produces many of them at this moment…and trying to replace them with other materials could take a long time, maybe the eternity if they cannot be replaced…”

“But China would suffer unemployment because of the elimination of exports to the United States; it won’t be easy to find new buyers for those products,” said Pere.

“There is an asymmetry here, Pere,” said Nicco, “2023 exports to the United States represented 2.9% of China’s GDP. Even if these exports fall to zero, China could absorb the loss with its normal growth. On the other hand, imports from China represent 14% of total US imports. Finding those supplies is much more difficult. There will be a scarcity of many items in the United States, especially for people with limited resources, and prices will go up for those people—the opposite of what The Prince said he wanted. Again, advantage goes to China.”[3]

“Moreover,” said John Maynard, “some large Chinese tech groups have launched a campaign to help Chinese exporters sell their products domestically. Chinese spend a share much smaller domestically than other countries with the same GDP per inhabitant.[4]

Nicco then added,

“In all these events, we can see another advantage for China. The Chinese have a much better risk analysis than the West, in the public and private sectors, and they act more quickly. In the West, and especially in the United States, they are rearranging the chairs on the deck of the Titanic and are not minding the huge hole in their ship.”

Nicco turned his head to look at Raven. The cat was still looking at him.

We’ll need to talk about this with Raven,” thought Nicco.

…..

Manuel Hinds is a Fellow at The Institute for Applied Economics, Global Health, and the Study of Business Enterprise at Johns Hopkins University. He shared the Manhattan Institute's 2010 Hayek Prize. He has worked in 35 countries as a division chief and then as a consultant to the World Bank. He was the Whitney H. Shepardson Fellow at the Council on Foreign Relations. His website is manuelhinds.com

[1] Harry Dempsey, Camilla Hodgson and Kana Iganaki, China’s rare earths controls prompt fears of auto shortages and shutdowns: Traders and executives warn of limited inventories and a risk of disruption to automotive production, Financial Times, April 20, 2025, https://www.ft.com/content/b8269eff-b60a-435f-8e85-43f9fa36f9c2

[2] Zjing Wu, Cheng Leng and Michael Acton, Nvidia blindsided by Trump’s curbs in multibillion dollar blow to China sales, Financial Times, April 16, 2025, https://www.ft.com/content/7935826a-ba3b-4f6b-a64d-b8167d5dc38e and Michael Acton, Demetri Sevastopulo and Tim Bradshaw, Nvidia to take $5.5 billion hit as US clamps down on exports of AI chips to China, April 15, 2025, https://www.ft.com/content/66e6abfa-2b79-407c-bda6-d04d19b3b814

[3] Luis Pinheiro de Matos, Exposure of the Chinese economy to a US tariff hike, CaixaBank Research, December 14, 2025, https://www.caixabankresearch.com/en/economics-markets/activity-growth/exposure-chinese-economy-us-tariff-hike

[4] Gloria Li, China Tech groups lead multibillion-dollar campaign to help exporters sell at home, Financial Times, April 20, 2025, https://www.ft.com/content/7e015987-b293-4031-85bc-e31c6d285d62?desktop=true&segmentId=d8d3e364-5197-20eb-17cf-2437841d178a#myft:notification:instant-email:content

"What is happening to the private sector, risk analysis, and strategic planning?”

A very good question. Trump has consistently said for decades that he us a protectionist. Why was this risk not included in the risk assessments of the private and public sectors?